That sounds like scam, how will they make money if they don’t charge for trades

This is feedback I got from an institutional trading buddy 2 years ago when I asked his thoughts on this new app called Robinhood.

Since then, it obviously has not been a scam and they are crushing it. More interestingly, it has created a new category of traders.

Let me explain.

I just read Howard Lindzon’s newsletter about the change in his investing workflow and it triggered thoughts about this new trading demographic. If you haven’t read it, here it is.

To start, Howard is spot on with this.

“the trade was commoditized to a few taps or swipes”.

Robinhood and co. have done amazing work for the trading experience. They have lowered the barrier to a point that we are seeing the creation of a new market in Mobile Traders.

These mobile traders, wanted to trade, were intimidated, didn’t want to pay fees and ultimately didn’t have the access they needed. Enter easy to use mobile apps and now they can trade whenever they want, from wherever they want and it only takes a click and a swipe.

Trading Has Been Commoditized

I also agree that we are heading into a tools phase.

“we are now headed into a world where those that want to be active need better and modern tools”

The industry has swung too far in the direction of simplicity. Mobile traders have gotten their feet wet and are no longer intimidated to trade. But in order to make good trades they need tools and this has created a new category of products.

Mobile Trader Tools

The one part that I don’t fully agree with Howard on, is his claim that the market will swing back to desktops. He may be talking about professional traders and if that’s the case I agree with that. I see similarities in my field ( software engineers) , where coding is being commoditized but there won’t be a shift away from desktops in the foreseeable future. Power users need their tools.

In this analysis I’m excluding the power users as they aren’t the demographic that made Robinhood so popular.

The truth is we are becoming more mobile in every aspect of life. Technology that allows us to continue that trend will win. We may take a short term step backwards, but long term, desktops will only be used by the power users. It’s a huge market, but I view it more as competition for Bloomberg terminals, not mobile trading platforms. This new mobile trader market will stop trading before they run back to a desktop.

Before mobile trading, traders didn’t have the time to make trades. It’s the exact reason why these platforms have blown up. They are busy, on the go, and don’t trade for a living. Mobile trading is here to stay, it will be up to the tools to enrich that experience.

The Solution

So we have overly simplistic trades, minimized screen real estate and busy traders. How do we supplement those users without forcing them to change their environment?

We bring the tools to them.

Through the use of notifications, you can identify your indicators (RSI), set the thresholds and get alerted when it’s time to act.

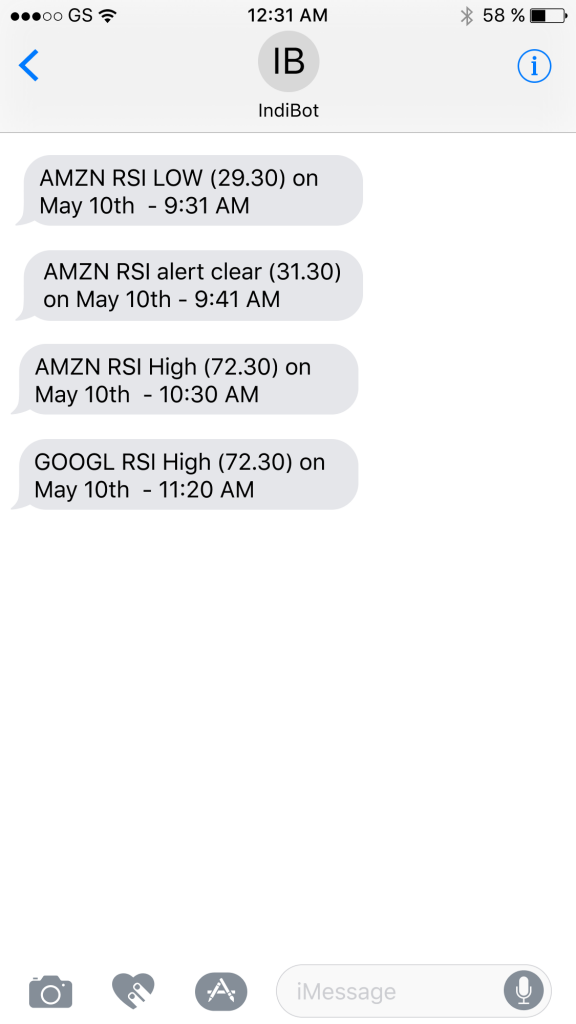

Here is an example of a solution that my buddy, Mike and I built to scratch our own itch.

It’s called Indibot and it automates indicator alerts via SMS. We have started with RSI as that was the most popular for us, but will be adding other indicators soon.

You can set your thresholds. Wait for your stocks to cross them and when you are driving up to take your 2nd shot on that par 4 (hopefully in the fairway), you get a text message. It’s Indibot informing you that AMZN has a low RSI and now you have the data to help you make a decision.

I’m excited for the future of commoditized trading. It can only get easier from here.

In the meantime I expect trading tools to be an important new vertical.